After crying hoarse over black money and pushing the UPA government to reveal the list of names shared by the Swiss government, the Modi government with its tall claims of bring back all the black money stashed away, refused to disclose the names on the list to the Supreme Court, which had set up the SIT to probe black money.

The central government told the Supreme Court that it could not disclose the names, received from foreign governments, of people who have allegedly stashed away their ill-gotten money in tax havens, as it was bound by the confidentiality clause under the double taxation avoidance agreement.

Its stand was made in an application seeking modification of an earlier court order asking it to disclose the names all such people it had received from German government to the petitioner Ram Jethmalani.

Attorney General Mukul Rohatgi mentioned the application for an urgent hearing before the bench of Chief Justice H.L.Dattu, Justice Madan B. Lokur and Justice A.K.Sikri.

The government said that the names of such account holders against whom the prosecution has been launched could be disclosed, as they are in public domain but in case of others, it was bound by the confidentiality clause.

The government has said that such disclosures would be counterproductive for get information on black money stashed away in tax havens, as foreign governments would not share such information in future.

The court had Aug 20 directed the central government to give Jethmalani details of the account holders in banks of Liechtenstein that were submitted to the court on May 1. The court’s order came as senior counsel Anil Divan told the court that government had given him the names of 18 people against whom prosecution has been launched but held back the names of eight people.

However, senior counsel Ram Jethmalani, petitioner in the plea seeking steps to bring back the black money stashed away to tax havens, assailed the government position saying that it could be position of people involved in taking ill-gotten money to tax havens and not that of the government.

Jethmalani Friday told the court that he had written a letter to Prime Minister Narendra Modi on the issue.

The apex court by its July 4, 2011 order had set up the SIT, which was mandated to undertake the investigations into the unaccounted money stashed away outside the country in tax havens and foreign banks and take steps to bring it back.

The SIT comprises the revenue secretary, the deputy governor of the Reserve Bank of India, the director of the Intelligence Bureau, the director, enforcement directorate, the director, of the Central Bureau of Investigation, the chairman of the Central Board of Direct Taxes, the director general of the Narcotics Control Bureau, director general, Revenue Intelligence, director, Financial Intelligence Unit, and Joint Secretary, (FT & TR-I) in the CBDT. The court had said that SIT would also include director, Research and Analysis Wing (RAW).

However, the SIT could not get operational until May 1 as the government dragged its feet on the issuing the notification. On May 1, the apex court held that there was no ambiguity in July 4, 2011 order and directed the central government to issue the necessary notification.

Initially by July 4, 2011, SIT was headed by former apex court judge Justice B.P.Jeevan Reddy with another former judge Justice M.B.Shah as second in commandA

However, Justice Jeevan Reddy withdrew from the SIT citing personal reasons. The court by its May 1 order made Justice M.B.Shah the chairman with another former apex court judge Justice Arijit Pasayat as vice chairman.

Meanwhile, Finance Minister Arun Jaitley Friday said India and Switzerland have reached an understanding on a number of issues regarding sharing of information in cases of black money being stashed in Swiss banks.

“A team of senior Finance Ministry officials which returned today (Friday) from Switzerland have been negotiating with the Swiss on a number of issues regarding information that India seeks on Black money,” Jaitley told reporters here.

“The Swiss have agreed to provide us bank information of names that we will provide them after there has been an investigation and evidence collected against that person.”

According to the minister, the Swiss authorities also agreed to accept any findings of Indian investigations into the black money issue as authentic and will co-operate in providing bank information of the people against whom evidence have been found.

“We have agreed to carry this process of sharing information in a time bound manner in which a time frame will be set for the process so that investigation and the request for information does not goes on forever,” Jaitley said whose ministry’s revenue secretary Shaktikanta Das and Chairman of the Central Board of Direct taxes (CBDT) K.V. Chowdary travelled to Switzerland to hold discussions with the authorities there.

The Finance Minister Jaitley said that the both sides have agreed to hold discussion for reaching an agreement for automatic sharing of information of account holders against whom substantial evidences have been found.

On the governments’ stand at the Supreme Court regarding disclosure of names of individual the ministry had received from foreign governments, Jaitley said that these names cannot be revealed due to a confidentiality clause in a double taxation avoidance agreement India had signed with Germany in 1995.

The disclosure can only happen, Jaitley said if a proper investigation is started against such individual and a substantial amount of evidence is found against them and given in a court of law.

The government has said that such disclosures would be counterproductive for getting further information on black money stashed away in tax havens, as foreign governments would not share such information in future. (IANS)

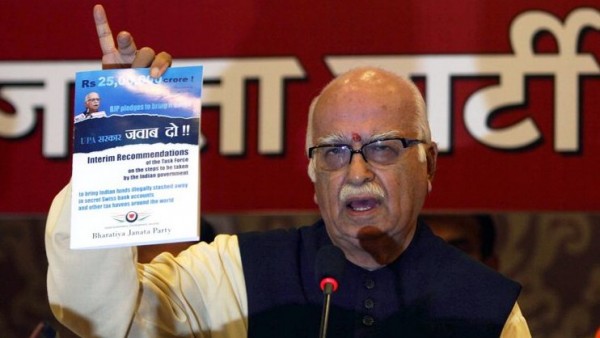

Only talk, no action: BJP’s prime ministeral candidate in 2009 L K Advani releases a report on black money by the party.

Only talk, no action: BJP’s prime ministeral candidate in 2009 L K Advani releases a report on black money by the party.